News

An Introduction to Grid Inertia and its Impact on Short-Term Power Markets 26 September 2023

An Introduction to Grid Inertia and its Impact on Short-Term Power Markets

Tom Bowcutt

Global Product Lead, Tradenergy®

With the growing level of renewables on the grid, the challenge of managing grid stability and the costs of adding inertia is growing, bringing new challenges to short-term power markets. Here at Reactive Technologies, we think about grid inertia all day, everyday — even on weekends, and especially on bank holidays! However, I am conscious this is a niche topic so wanted to provide an introduction to the key concepts and illustrate, via some examples, how the management of grid inertia is impacting the GB market currently, and how this may evolve in the future.

What is grid inertia?

Inertia is the idea that an object will continue its current motion until some force causes its’ speed or direction to change. In the context of power grids, we are talking about the motion of the large spinning mass of metal in the turbines of traditional generation sources such as gas and coal power stations. Some have made the analogy to a fat hamster on its wheel – even when it falls off, the wheel keeps spinning. As we transition to high levels of renewables, we are reducing the amount of inertia on the grid. I like to think of it as the hamster going on a diet!

Why should we care?

Put simply, grid inertia helps avoid black outs and keep the lights on!

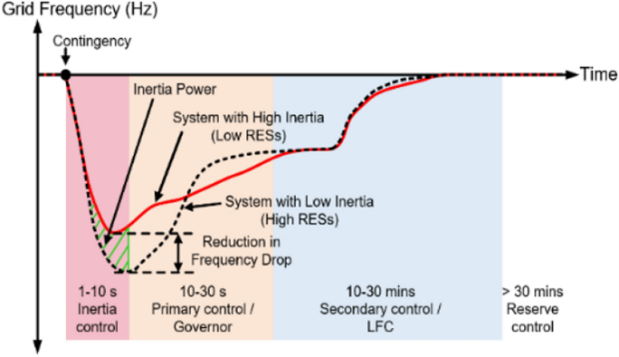

If you are reading this you are likely already aware that grid operators must maintain a constant balance between power generation and demand to keep the frequency within an operating tolerance. In GB, National Grid ESO must keep the frequency within with +/- 0.5Hz of 50 Hz (and in practice, operationally work to +/- 0.2 Hz).

Failure to keep the frequency within these targets can lead to a cascade effect. As the frequency drops – this causes generation output to drop (as they synchronise to the lower frequency), further reducing the frequency and so on. This snowball effect can eventually lead to a black out. One well documented example occurred on 9th August 2019, which led to major disruption in the transport sector and power outages for over one million consumers.

What can we do about it?

As an island grid with relatively high renewables penetration, GB is already ahead of some other European countries in terms of seeing the impact of lower inertia levels on grid stability. Some of the actions being taken include:

– Faster Frequency Response Services: Introduction of faster acting frequency response services such as Dynamic Containment, which requires a response within 0.5 to 1s of a frequency deviation (typically delivered by batteries).

– Implementing live inertia measurement tools: Reactive Technologies has developed the world’s first method of live measuring grid inertia, which is now being adopted globally by Grid Operators (for more details, see).

– Market Actions to add inertia: Grid operators take market actions to proactively increase the level of inertia on their system, for example by increasing the level of gas generation in the fuel mix and managing imports and exports via interconnectors.

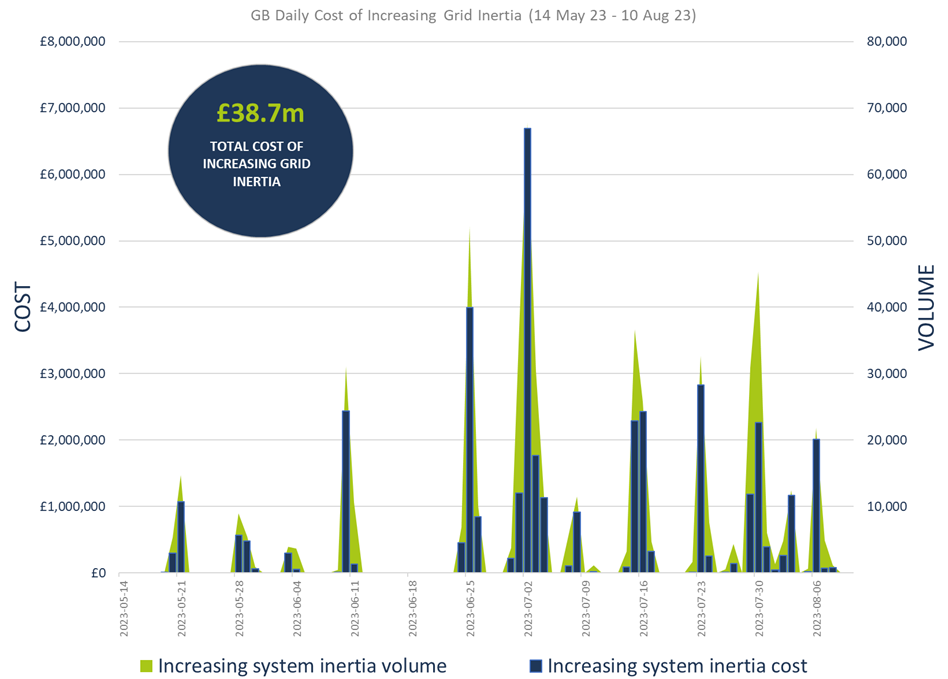

What does it cost?

We have seen an exponential growth in the year-on-year cost of managing the RoCoF (Rate of Change of Frequency) within the GB market. Between May and Aug 2023, the cost of adding inertia to the GB grid exceeded £38m, with £6.6m spent on a single day (01 July). These costs are ultimately recovered from consumers via their bills.

What is the impact on short-term power markets?

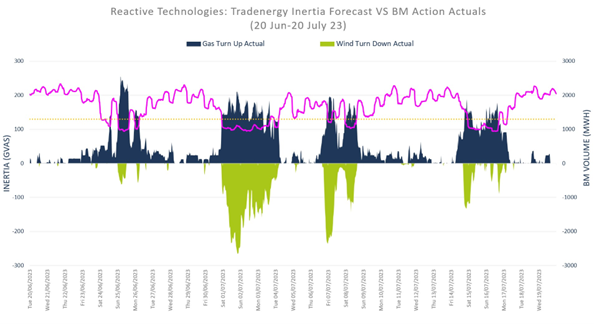

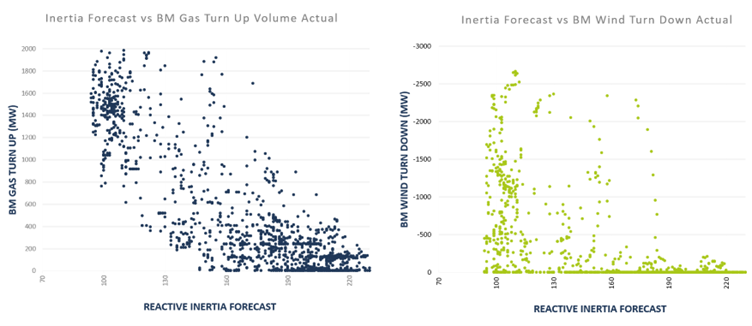

The chart below shows the Reactive Technologies inertia forecast from our Tradenergy® product plotted against the volume of Gas turn up and wind turn down via the balancing market between 20 June to 20 July 2023. During periods of low forecast inertia, we see high levels of gas generation turn up and offsetting curtailment of wind units in the balancing market.

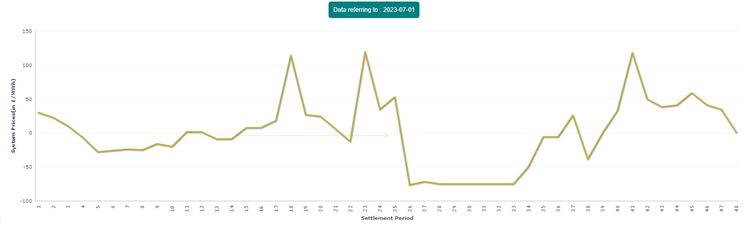

Looking more closely at the day with the largest spend on inertia management (1 July 2023), we saw ten settlement periods of negative imbalance / system prices of around -£75/MWh in a long market (more generation than demand). Prior to this, we saw a short system (less generation than demand), with a positive price peak of £119/MWh.

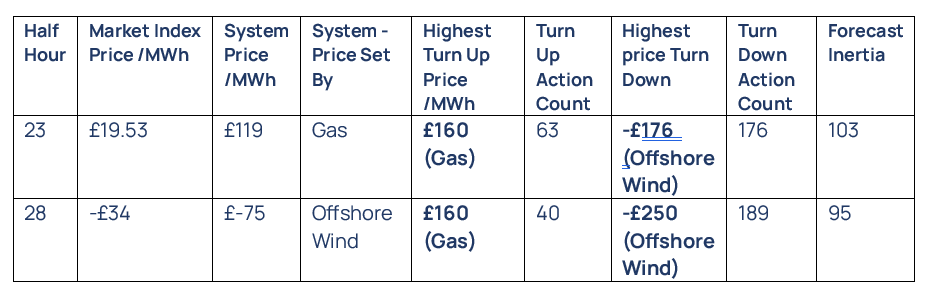

Digging a level deeper into the detailed price stack (available on BM REPORTs), we can see both gas and offshore wind being paid to change their output via system operator tagged constraint actions.

Constraint actions are those that are not required to maintain the energy balance between generation and demand but are necessary to maintain operation of the grid (for example, ensuring power flows align with grid capacity, manage thermal constraints, etc)

Constraint actions are often taken out of merit order, meaning more expensive prices are accepted by the grid operator than might otherwise be the case when managing energy balance. Whilst constraint actions should be removed from the calculation of system prices via both system operator flagging and the various tagging mechanisms in the imbalance pricing calculation run by Elexon, they do lead to relatively high prices being achieved by those assets which are helping to support the operation of the grid.

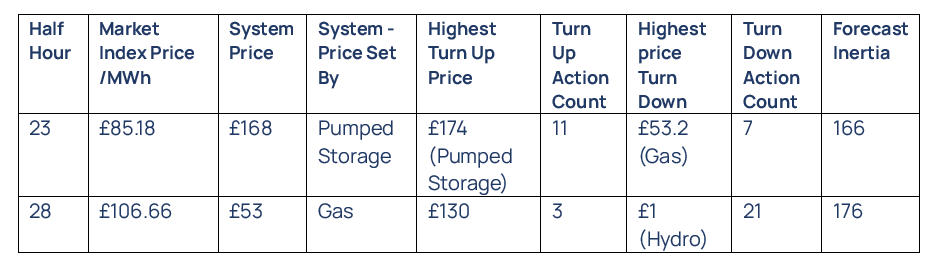

For example, half hours 23 and 29, we see Offshore wind being paid up to £250/MWh to turn down output, whilst at the same time gas is being paid £160 /MWh to turn up output. The prices of these actions are at a premium to both the intraday market index price (£19.53 and -£34) and the system prices (£119 and -£75) for the same periods. This was a busy period in the balancing mechanisms, with a total of 468 actions in the price stack for these two half hours.

By way of contrast, on 4 July, we see high levels of forecast inertia and a much smaller number of actions being taken at prices more closely aligned to the market. Only 42 actions appear in the price stacks for these periods.

How Tradenergy® helps

From this data, we can clearly see the increasing spend and large number of market actions being taken to manage the grid, including adding inertia, due to increased renewables penetration. Inertia forecasts provided by Reactive’s Tradenergy® service give a strong indication of when these periods will occur, during which time assets helping to alleviate system challenges are likely to achieve prices at a premium to the wholesale market.

Future Direction

With increasing levels of renewables on the grid, these challenges are likely to grow in the future. Similar issues facing island grids will soon start to affect larger networks such as mainland Europe. Already grid operators around the world are looking ahead to how they can better monitor inertia levels on their network. Similarly, distribution network operators with increasing amounts of distributed energy resources on their grids will need to closely monitor system strength.

Within the UK, we have already seen the grid operator running a Stability Pathfinder project, which included the procurement of inertia via long term contracts from suitable assets. I expect that these innovation projects will eventually lead to development of an ancillary service market for inertia. Likely procured via a day ahead market – as we have seen with the evolution of frequency response. Asset developers and operators will require more insight on inertia, both when planning where to locate their assets and when optimising across potential revenue streams in the short term / day ahead horizon.

Ultimately, power markets are designed and driven by the short-term grid physics of the instantaneous generation and demand balance. With increasing dependency on intermittent renewables, decentralised generation, and pressure on the distribution networks, I only see the trend of increased volatility and focus on short power markets ahead of longer-term trading continuing. In this more volatile market, traders with the fastest real time data and best automation of trade execution will have increasing advantage.

Conclusion

I hope this introduction to grid inertia helps demystify a relatively niche area of power markets. At Reactive Technologies we are passionate about all things related to power grids and are always happy to help build transparency and support others on the Net Zero journey. So, feel free to reach out with questions, comments, and even corrections!

Ready to learn more about Tradenergy®?

Learn how Tradenergy® can help you make more profitable trading decisions.

Learn moreMore Articles

- Frost & Sullivan Recognizes Reactive Technologies with the 2017 Global Distributed Energy Company of the Year Award

- Unlocking Profitable Short-Term Power Trading: Dive into the Joint Paper by Brady Technologies and Reactive Technologies

- Former ENTSO-E Chairman Joachim Vanzetta joins Advisory Board of Reactive Technologies

- Transitioning from DNO to DSO: The Role of Visibility

- Reactive Technologies Statement on Publication of National Grid Power Outage Report by Ofgem